Smarter Data, Safer Banking

Share your financial data digitally, with your explicit consent via OTP.

Consent - based data sharing via OTP

RBI-approved Account Aggregator framework

Share your financial data digitally, with your explicit consent via OTP.

Key Features

Link multiple accounts and share financial data using an OTP

No more misplaced documents. No physical collection or submission– only digital sharing

Privacy is priority

End-to-end encryption keeps your financial data private between you and ICICI Bank

Share only what’s required, with your explicit consent

Secure and safe data sharing

Your data is protected with robust security features as per ReBIT standards

The Account Aggregator (AA) framework, licensed by RBI, enables secure data exchange between banks or financial institutions, always with your explicit consent.

In this framework, the Financial Information Provider (e.g. your bank) shares your relevant data with the Financial Information User (e.g. a lender where you have applied for a loan) to process your request, and the Account Aggregator framework securely transfers it between them.

ICICI Bank is an early and active participant in this framework, making your banking journey simpler, faster and safer.

Whether it’s for applying for a loan / Credit Card or for managing your finances better, Account Aggregator enhances your experience.

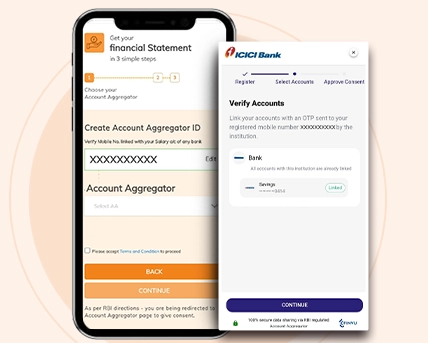

Click on 'Account Aggregator' to share your financial data, when prompted

Discover & link your bank accounts

Review and accept the consent request

Your financial data will be shared with ICICI Bank

You can experience AA journey for any of the products listed below.

Yes, Account Aggregators are RBI-licensed entities (NBFC – AAs) regulated under the Account Aggregator framework. They follow security standards defined by ReBIT (Reserve Bank Information Technology Private Limited).

Currently, you can share Savings Account, Current Account, Mutual Fund and Equity statements for individuals through the Account Aggregator framework. For all business entities, GST data can also be shared.

No, ICICI Bank participates in the Account Aggregator (AA) framework as both a Financial Information Provider (FIP) and a Financial Information User (FIU).

Click here to view all banks that are currently part of the Account Aggregator framework.

An FIP (Financial Information Provider) is an institution that holds your financial data. An FIU (Financial Information User) is an institution that uses your data to offer relevant products / services.

No. Account Aggregator only acts as a secure carrier of your data. Data is shared only with your consent and the entire exchange is encrypted as per guidelines defined by ReBIT. Because of this, AA cannot store, view or use your data.

Currently Account Aggregator does not charge customers for sharing financial data using its framework.

Account Aggregator allows you to share statements of multiple bank accounts, but only with your explicit consent.

ICICI Bank does not charge customers for sharing their financial data using the Account Aggregator framework.

Currently statements of only single / individual accounts can be shared using Account Aggregator framework.

Account Aggregator works as a bridge – it only transfers your data securely from one financial institution to another, in an encrypted form. Your data is not stored with AA. Encryption and decryption are strictly governed by ReBIT standards, ensuring complete security.

Account Aggregator allows customers to link their accounts held with multiple financial institutions that are part of the Account Aggregator framework and to share financial information with a single consent.

No. Account Aggregator framework is only a medium to share financial information. However, your bank must be part of the Account Aggregator framework for you to link accounts or share data.

No, data can be shared only after receiving your consent digitally.

Yes, account linking is mandatory to share data.

Yes, you can access Account Aggregator services through both web-based and mobile-based platforms. Simply visit their website or download their app from Play Store/App Store. You can log in or follow their handle using your mobile number.

Account Aggregator can't view or store any data. All financial information is sourced with the consent of the customer and flows between the Financial Information Provider (FIP) and Financial Information User (FIU) only.