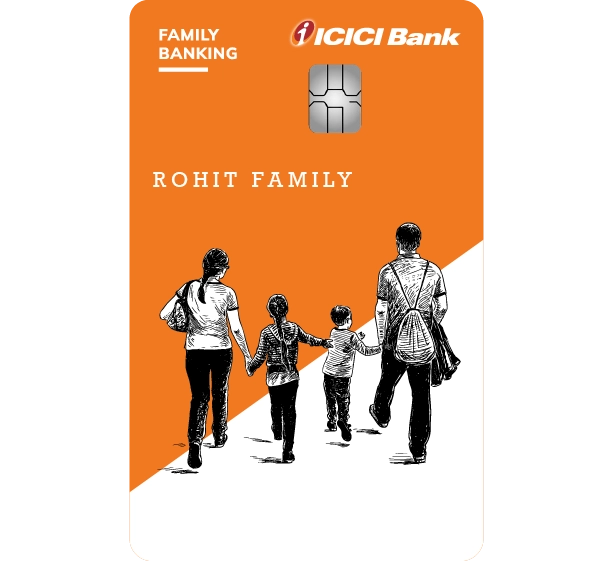

Debit Cards that make life convenient

ICICI Bank Debit Cards offer secure and convenient online or in-store payments. Use them to withdraw cash, pay bills, shop, or plan getaways. Enjoy hassle-free daily spending without the need to carry cash.

Global Use

Cashless Transaction

Rewards

-

39,996 PEOPLE ARE INTERESTED