Shadow vs Light in Personal Finance: Know the Hidden Costs

2-minute read

Stand outside on a sunny day. You see light. You also see your shadow.

The light is clear, visible and obvious. The shadow? Subtle, often ignored but always present.

Personal finance works exactly the same way. Most of us stay in the light, saving money, investing in Fixed Deposits (FDs), Mutual Funds or stocks and paying Credit Card bills on time. These are good, even necessary habits. But they are also the visible basics that everyone knows about.

However, the real difference arises when you account for what lies in the shadows too, the things people often miss but which shape long-term financial health.

The Shadow: Hidden Financial Costs Every Investor Must Know

The quieter parts of money management do not get much attention, but ignoring them can throw your finances off balance.

These are blind spots that exist because people focus only on what is easy to see.

The Illusion of Growth in Investments

How Inflation and Taxes Affect Real Investment Returns

Let us understand this through Rohan’s example.

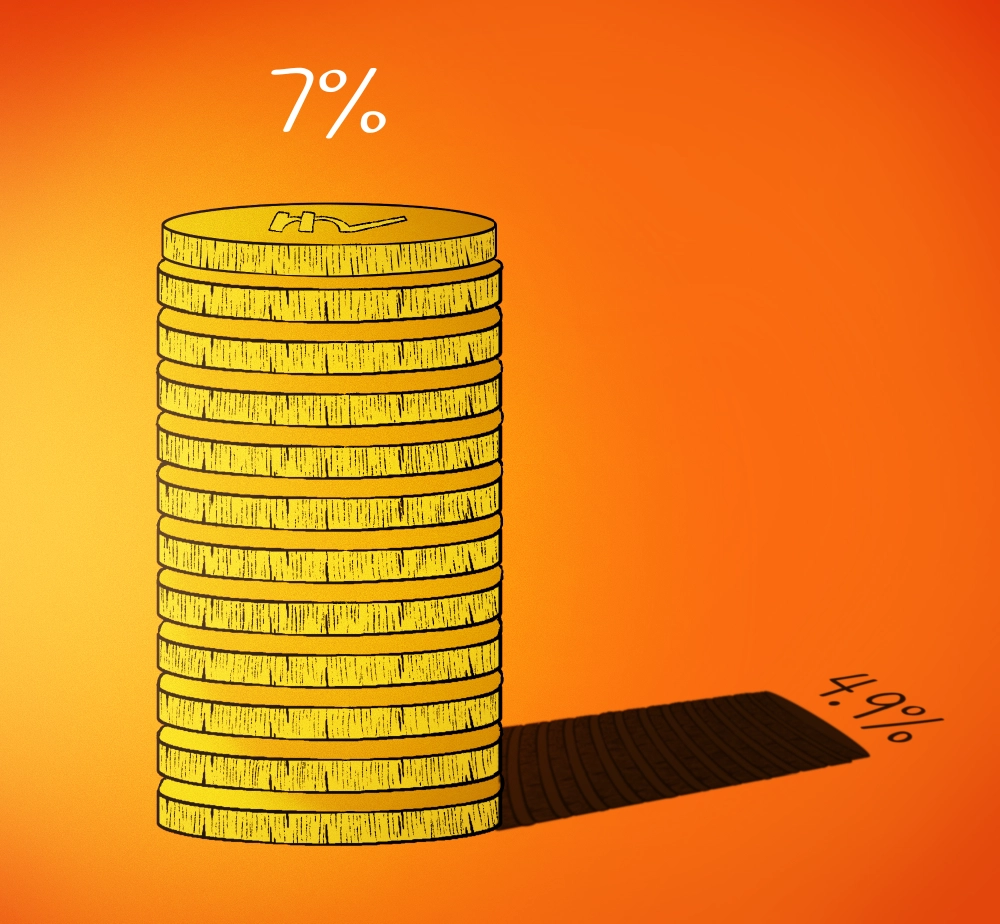

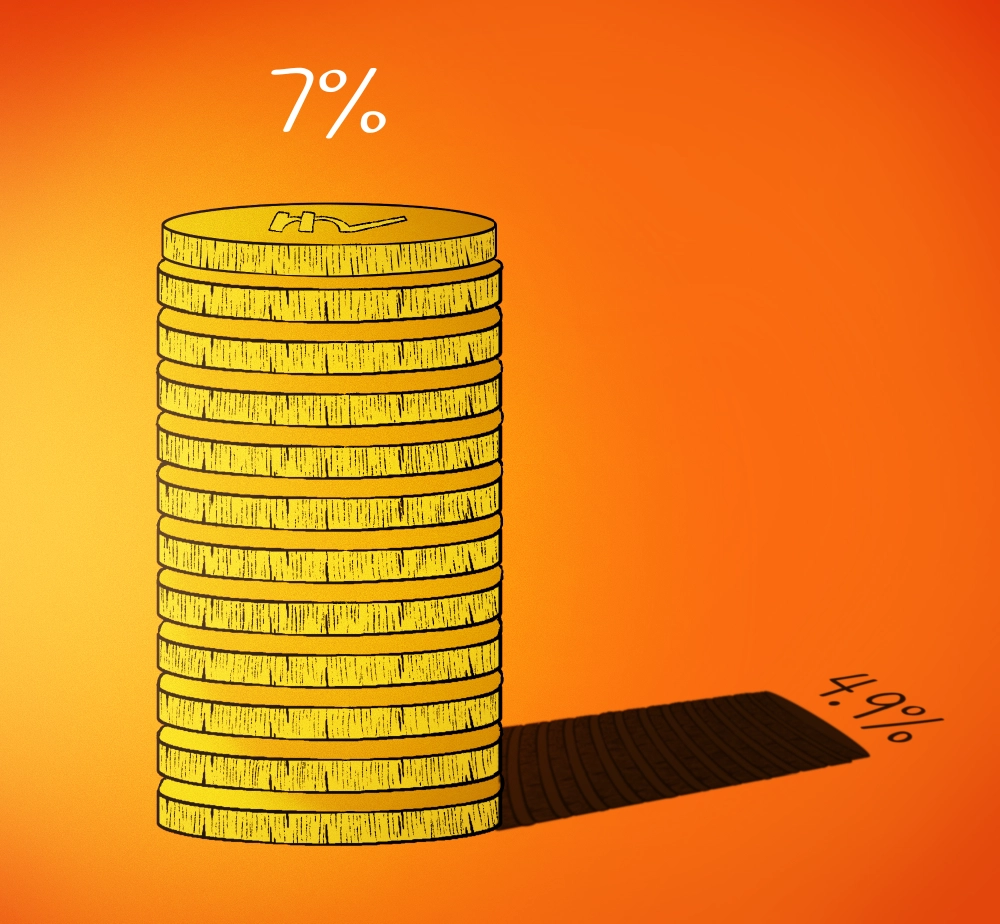

At 36, Rohan felt his money was in safe hands. Back in 2015, he invested ₹1 lakh in a 10-year bond offering 7%. ‘Guaranteed income, no stock market risk,’ he thought.

Fast forward to 2025. On paper, his investment had grown to around ₹1.63 lakh. A tidy 63% gain without any effort. The numbers looked reassuring.

But here’s the twist.

In a 30% tax bracket, his post-tax returns weren’t really 7%, but closer to 4.9%. Add inflation into the mix with India’s average inflation rate over the past decade at ~5%*.

Now, compare the two:

Result? The ₹1.63 lakh in 2025 could buy less than what ₹1 lakh did back in 2015. His nominal returns looked great but in real terms, his purchasing power shrank.

That’s the danger of ignoring the shadows. The light shows you growth. The shadow shows whether that growth is real or just an illusion.

True financial health comes from balancing both the light, which is visible and the shadows, which are usually overlooked.

*Retail Inflation Rate. Source: Press Information Bureau 2024-25

Tax Benefits are subject to amendments in tax laws from time to time.