The stock market isn’t the only place where trading happens. Away from the spotlight lies the world of unlisted stocks.

These are shares of companies not yet trading on the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

OCTOBER 2025 | VOL. 53

The stock market isn’t the only place where trading happens. Away from the spotlight lies the world of unlisted stocks.

These are shares of companies not yet trading on the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

The idea sounds exciting.

But beneath the surface, this market is far less predictable, where information is scarce, valuations are uncertain and exits are anything but easy.

Start-ups

Pre- Initial Public Offering (IPO) companies

Subsidiaries of listed firms

However, investing here is not as straightforward as buying listed shares.

The Challenges

Unlike listed companies, unlisted firms don't have to publish quarterly results or detailed disclosores

Investors often rely on secondary sources or broker reports

Selling unlisted shares can be difficult

There is no open market, so finding a buyer may take time and may require selling at a discount

Without

market-driven pricing, shares may be overvalued or undervalued

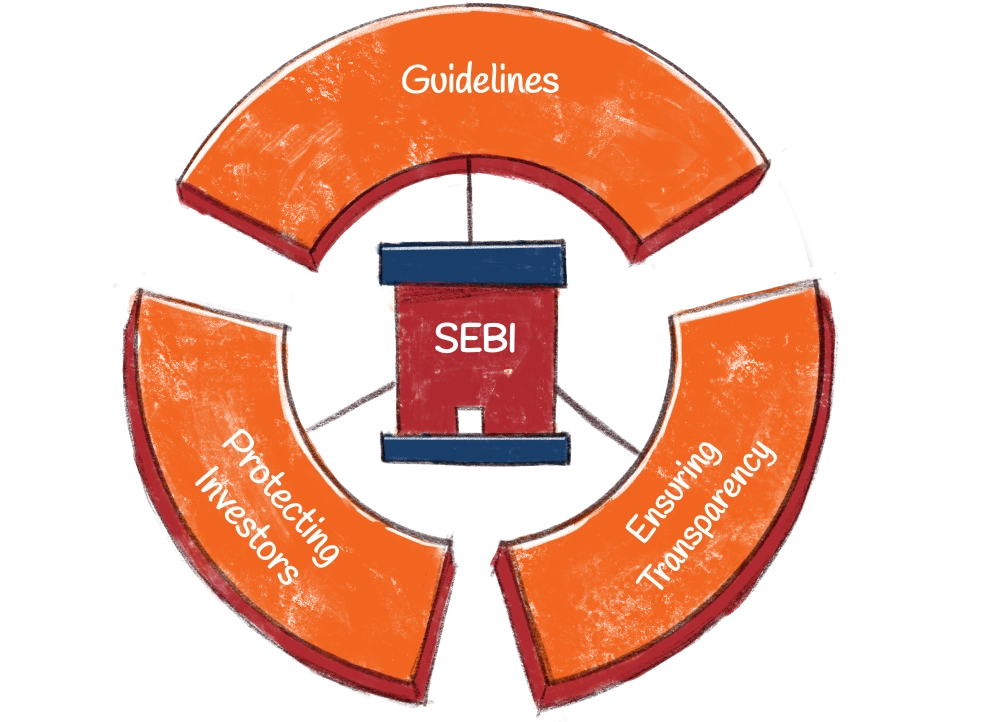

The Role of SEBI

Securities and Exchange Board of India (SEBI) does not oversee unlisted shares as it does for listed ones on formal stock exchanges

It simply has guidelines to protect investors in unlisted public companies, focusing on disclosures and ensuring transparency in the grey market

Proposed SEBI Framework

SEBI has proposed collaborating with the corporate affairs ministry to create a regulated platform for pre-IPO or unlisted companies to allow for trading with necessary disclosures.